Reverse Factoring

Groupe ACFI specializes in the structuring, implementation and deployment of Reverse Factoring programs, with a comprehensive, innovative and tailor-made approach.

Reverse Factoring

Reverse Factoring is a Supply Chain Finance program initiated by a Purchaser and involving its suppliers.

Previously reserved for very large companies, and still not widely used, Reverse Factoring is now in vogue because it secures, finances and ultimately reduces inter-company credit.

Reverse Factoring enables a Buyer to have invoices due to its suppliers paid rapidly by a financial institution in order to :

Secure your supplies

Financing growth

Giving suppliers visibility and financing

Negotiate repayment terms with your financial institution

Challenges of a Reverse Factoring program

A Reverse Factoring program is part of a win-win relationship between the client and its suppliers. It strengthens their commercial partnership, streamlines their administrative exchanges and secures their financial transactions.

Reverse Factoring is based on the real-time exchange of dematerialized information on invoices issued by suppliers.

From the electronic platform, the supplier obtains :

Full visibility of outstanding invoices and their status

Early payment of validated invoices

Significant time savings in administrative invoice processing

The keys to reverse factoring success

The implementation of a Reverse Factoring program involves various departments within the company:

At the customer's

Purchasing, Logistics, Finance, Accounting, IT, Legal

At the Supplier

Sales, Finance, Legal

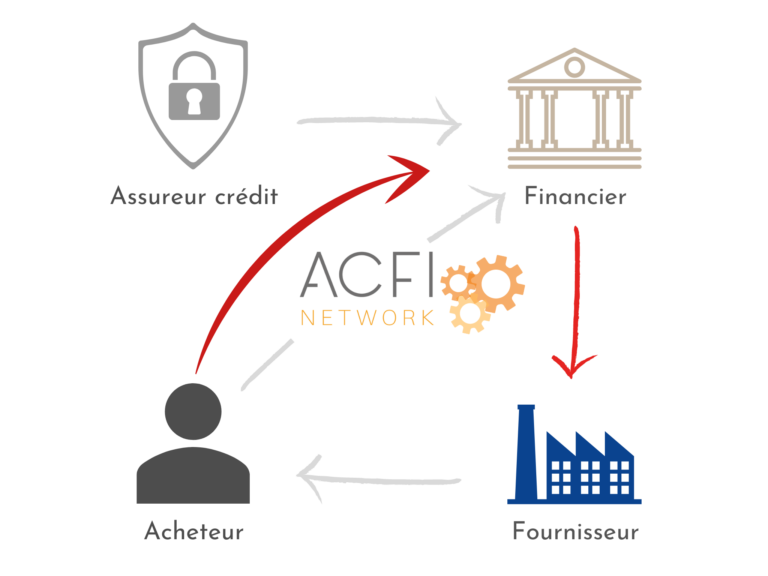

Its operation involves :

One or more financial institutions

One or more credit insurers

Groupe ACFI has been structuring Reverse Factoring programs for more than 10 years, and is able to support the client at every stage:

- Supplier analysis

- Structuring the program with the departments involved

- Managing the call for tenders from financial institutions and credit insurers

- Setting up the electronic platform

- Team training

- Deploying the program through supplier buy-in

Who is Reverse Factoring for?

Our expertise in the implementation of Reverse Factoring programs enables us to democratize this offer and propose it to principals with sales of a few tens of millions of € or more.

Reverse Factoring is particularly well-suited to the needs of clients who want to be exemplary in terms of invoice payment deadlines, or those who have a structurally high level of working capital as a result of their business activity:

Highly seasonal

Textiles, food processing, sporting goods...

Industries with long manufacturing cycles

Machine tools, aeronautics, automotive...

Complex billing circuit or short payment terms

Construction, transport...

Large inventories

Wholesalers and retailers

Exporting companies

Exporting companies facing longer payment terms